Psy’s ‘Gangnam Style’ might have catapulted the South Korean music market into the global consciousness but to industry observers like myself it has long been a market of particular interest. Being the first major music market to pass the 50% digital mark – in 2006 – South Korea has been held up both as a digital trailblazer and as a canary in the mine for the global music industry. Strong growth over recent years hinted at a brighter international future, but just as ‘Gangnam Style’ was propelling South Korean music to unprecedented global heights the South Korea music market went back into decline.

The South Korean music market is one of contradictions and idiosyncrasies, but crucially it also holds many lessons that the global music market would do well to pay heed to.

Bucking Global Trends

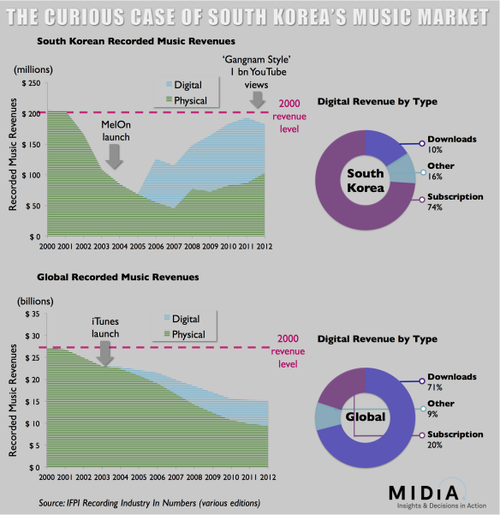

According to the IFPI’s invaluable Recording Industry in Numbers, South Korean recorded music revenues declined by 5% in 2012, breaking a run of four years of successive growth. But unlike the global market, it wasn’t the CD that was to blame for the fall but digital. Physical revenue grew by 19%, the third successive year of growth, while digital actually declined by 25%, dragging the entire market down with it. The mirror opposite of the global music market where 7% digital growth wasn’t enough to prevent a 5% physical decline drag down total revenues by 1%.

2012 wasn’t the first year that South Korea stood out from the pack though, indeed the last 13 years have been vastly different from the global market (see figure):

- Revenue collapse: between 2000 and 2005 South Korea lost a whopping two thirds of its value while the global market shrunk by a more modest 18%

- Digital crossover: in 2006 South Korea became the first major music market to become more than 50% digital (the 2012 global rate was just 38%)

- Subscription dominance: a vast 74% of digital revenues were subscription in 2012, having hit 22% back In 2008 (the global rate was just 20%)

- Physical boom: physical revenues have risen all years but one since 2007, compared to a global market decline every year since 2000

A Tale of Booming CD Sales and Tumbling Download Revenues

There is no single explanation for the unique picture that South Korea’s last 13 years of music history paints, but there are a few key factors:

- Piracy: piracy is of course just one contributory factor to the downturn in music revenues (albeit a crucial one) but the effect was felt particularly keenly in South Korea. The South Korean government was an ardent supporter of the telco sector in the 1990’s and early 2000’s, resulting in some of the best high-speed broadband infrastructure on the planet. However this support came at the cost of the government effectively turning a blind eye to rights holder concerns. Unsurprisingly piracy boomed with file sharers and networks alike operating with near impunity. South Korea became a perennial fixture on the US Trade Representative’s piracy watch list but finally the government started to redress the balance from 2007/8, introducing new copyright legislation, including a graduated response initiative in 2009. And since 2007 the market has grown by an impressive 58%, nearly reaching 2000 levels by 2011. But just how much of this can be attributed to government action is open to question as music revenues had already grown by 84% in 2006 alone. (The rate of growth in 2006 is however skewed by the fact digital numbers were not reported in prior years).

- Subscriptions: the central force in South Korea’s digital market is SK Telecom’s MelOn subscription service which was the first in the world to amass a million paying subscribers and now numbers 2 million paying users and 18 million registered users. MelOn was competitively priced (less than $3.00) and included mobile downloads from the start, enabling it to have immediate impact. South Korean subscription revenues more than doubled between 2009 and 2012. Rights holders have not been entirely happy though, including Lee-Soo Man (founder of K-Pop power house SM Entertainment) who claimed that 1 million tracks consumed on MelOn do not cover the costs of making a music video for a single. The pressure resulted in government intervention and in January 2013 MelOn doubled its subscription rate to 6,000 won (about $5.60). Time will soon tell whether the increased revenue per user is cancelled out by the likely decline in number of users.

- Download collapse: MelOn’s price hike of course came after 2012 digital decline, which instead was caused by a collapse in music download revenue, dropping by a staggering 71% in 2012. The download collapse was the single biggest driver of the overall decline in revenue in 2012. In fact, if download revenue had remained flat, total revenues would have grown by 6% in 2012. Much of the decline is attributed to a tough year for another of SK Telecom’s properties, the social network Cyworld. Once the dominant Korean network, Cyworld enables users to buy music tracks to personalize their profiles but it has struggled to compete against Facebook and spent 2012 bleeding users.

- Physical longevity: physical revenues have bucked the global trend, with 2012 revenues 128% bigger than their 2006 low. This compares to a 14% rise for digital (though the 2012 collapse obviously skews the rate down). It is not a unique trend though, with Japan also experiencing a physical uptick in 2012. What links these two markets is the way in which the respective local pop sectors (K-Pop and J-Pop) have created ardently loyal fan bases that eagerly buy lavishly packaged CD products, often with merchandize extras, and frequently resulting in fans buying multiple editions of the same release. Thus for all the surge in digital, the South Korean and Japanese pop markets have found a way to deliver unique, tangible value with physical products.

- K-Pop: though the success of K-Pop has been key to South Korean market growth there is growing criticism of this highly manufactured genre. Artists complain of being ‘contract slaves’ while others point to the huge concentration of power in the K-Pop talent agencies. A cultural critique is that this industrialized pop methodology places too heavy an emphasis on presentation over content, and too strong a focus on ‘safe bet’ lowest common denominators. A clear echo of the American Idol and X-Factor phenomenon in the West. Whatever its issues though, there is no denying that K-Pop is central to the resurgence in South Korean music revenues.

Lessons for the Global Market

South Korea is a truly unique music market and, just as with Japan, one has to tread carefully when attempting to project trends onto western markets. But even with that caveat there is clearly much that can be learned from the South Korean experience:

- It is possible for music revenues to return to 2000 levels (if only for a fleeting moment)

- Subscriptions can reach significant scale when competitively priced (sustainability issues aside)

- Physical revenues can be given new impetus with smart product strategy (though don’t expect Westerners to start behaving like K-Pop fans)

- Concentration of any one segment of digital revenue in a single player can leave a market highly vulnerable

But perhaps most importantly of all, just like in the disclaimer of a financial services advert: music revenues can go up and down. Even when a market eventually starts to grow again, don’t expect that to mean that the corner has been permanently turned.

Source: Music Industry Blog