Today, each merchant in India are considering twice before they trading for crude oil, owing to fluctuate levels . This particular product is worrying across the entire portfolio of certain commodity investors. What are the factors that cause crude oil commodity highly volatile and fluctuating? We address these factors too, but prior to that we will to talk about why crude oil is as significant from the point of trading view.

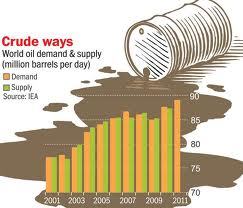

In fact, oil is the most frequently used source of energy across the globe and is responsible for about 45% of worldwide energy in demand and its consumption estimated at greater than 90 million barrels a day. As India is among the countries not belonging to OPEC (Organization of Petroleum Exporting Countries), so they are far more reliant on crude oil import to comply with our internal consumer demand as we need a level far the lowest production. Earlier, India was a lot more reliant on coal for its power needs, but such as the weather changes, the necessity and the forms of intake of energy sources have also changed and now a days, the oil and gas industry contributing to about 50% of overall energy intake in the country. When we consider the largest importers oil by millions of barrels daily, India is ranked fourth be listed with imported 4.16 million billion barrels per day. This is the reason that crude oil as that important to us as a power source and as well as commodity.

There is some factors that cause crude oil a staple to invest in:

An investor at the raw materials market the crude oil, you need to learn to take advantage of the predictions in place of current prices. Always learns of the potential price increases, then it is in time that you must be purchased additional shares in this market. And at the moment there is forecasts to the contrary, it is time to sell, and which are guaranteed to make a huge profit. The crude commodities market is fairly rare oil as without precedent ranges. Current circumstances nearly never duplicated in future at least not to an exact INN. So, as the investor, you can never fully trust the information passed to make decisions regarding the current situation. Always strive to be intuitively concerning trade relying on passed owing, it is a risk who can not afford.

Crude oil commodity trading evaluate is only one factor to help you you discover out far more about investing. If you would like to find out much more about guide or commodity tips. Visit our website link to learn more about commodities or crude oil tips.