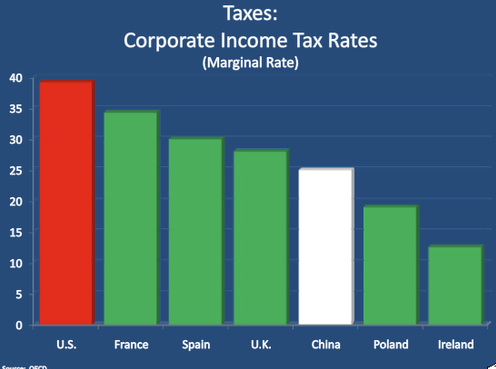

Yesterday, Evilteabagger posted the following chart:

This chart seems to show that U.S. corporate income taxes are higher than the rest of the world. C'est inconcevable!

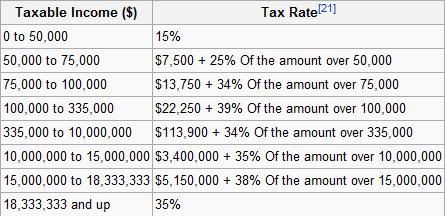

First off, it is important to remember that this chart only shows the highest corporate tax rate. The corporate income tax is graduated the same way that individual income taxes are:

Secondly, you will notice in the table above that America’s corporate income tax is actually regressive: corporations with gross profits exceeding $18,333,333 are subject to a lower tax than 2 preceding brackets. So the original chart is misleading in 2 ways: it suggests to the viewer that all corporate income is subject to the highest rate, regardless of income, and it also implies, at a minimum, that high-earning corporations are subject to the 39% rate. That’s false. Only corporations with $100,000-$335,000 are subject to the 39% rate.

Thirdly, no corporation actually pays their assigned marginal rate. There are so many deductions, exemptions, and credits in our tax code, for both individuals and corporations, that we are lucky to be getting any revenue at all, especially from big corporations. Bank of America and Wells Fargo paid virtually no federal income taxes last year. Google effectively paid a 2.4% tax rate in 2010. A company spokeswoman said that Google’s practices “are very similar to those at countless other global companies operating across a wide range of industries.”

Many corporations also use shell corporations through which they disperse their revenues prior to filing taxes. This allows them not only to file at a lower rate, but each individual shell now has renewed access to many of the deductions and exemptions that the original corporation may have exhausted.

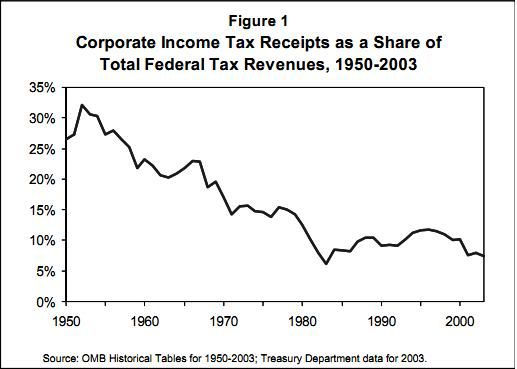

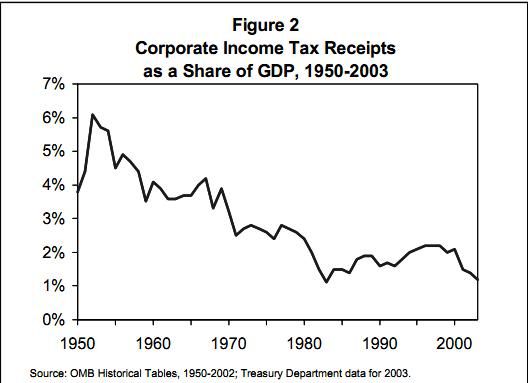

So while our top marginal corporate tax rate may be high, it doesn’t change the fact that virtually nobody is paying it. And many of our largest, most successful corporations are barely paying anything at all. In fact, corporate taxes constitute a smaller share of federal revenues today than at any time in recent history:

So let’s not pretend that our corporations are over-taxed. In both real and historical terms, American corporations are paying less taxes than they have at anytime in the last half century. Statutory marginal tax rates do not reflect in any real sense the amount of taxes that corporations actually pay at tax time.

thetipsytoad2-blog reblogged this from taylorhowlett-blog

taylorhowlett-blog liked this

pilar-estrella liked this

trxfreely liked this

spacecaptainsenia liked this

marxbakuninhomoeroticfanfiction liked this

wehdile-temporary-blog liked this

partiingshot liked this

waronidiocy liked this

letterstomycountry posted this

- Show more notes