Sunday Coffee and Real Estate

Diane Rae Jones, Broker Coldwell Banker Danforth Northgate - 11300 Pinehurst Way NE, Seattle, WA 98125

If you are thinking about buying a home, then you are probably thinking about a mortgage. The first thing you should do before getting down to shopping is have a talk with your mortgage professional and get qualified for a mortgage amount. In plain terms, this is the top number the bank will risk on you. This amount, plus your down payment, will cover the home purchase price plus closing and mortgage costs (see my posts here and here for more information on those).

Then, you should give serious thought as to how much money you want to spend on a home. Qualifying for a loan amount is one thing, but you may have other priorities for your money and don’t want to spend at your upper limit. When considering this, remember to factor in the costs of owning a home:

• Property taxes (usually income-tax deductible, but still a cost)

• Maintenance & upgrade costs

Yard

Roof

Siding

Porches/deck

Doors & windows

Plumbing

Furnace

Water heater

Appliances

• Inevitable repairs (see the list above)

• Remodeling

• Furniture, window treatments and other purchases.

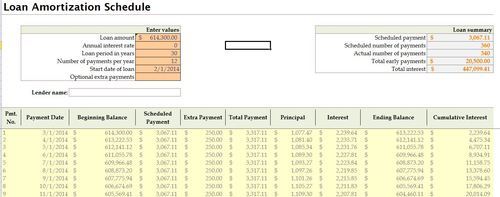

The items that comprise the cost of getting the mortgage loan is included in the post here. Then, the cost of keeping the loan is the interest rate. You can run your own loan amortization tables to figure your payment and total interest paid at any point in the loan term. I get mine from Microsoft Office templates via Excel. Just plug in your loan period (30 years or other), interest rate, loan amount and the start date of your loan. Many tables also have the option to plug in extra payments on principal.

Here is a screen shot of the one I’ve been using for my clients:

I like this option better than the website amortization schedules since I can save them and try different scenarios offline.

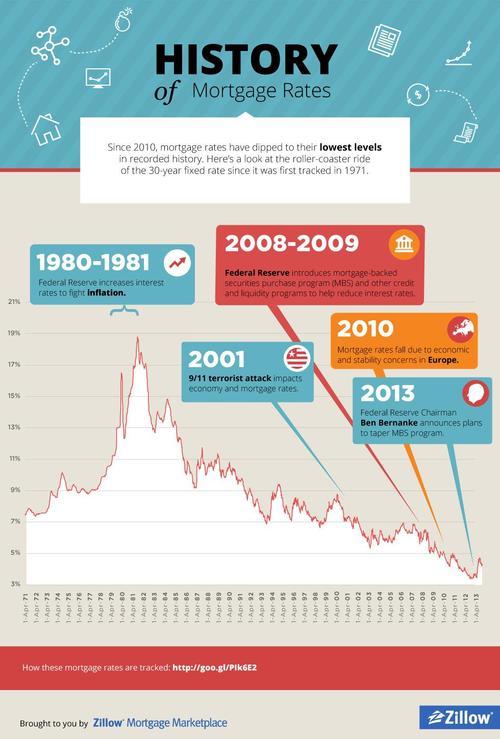

While we’re on the topic of mortgages, you will hear the exhortation that “now is a great time to buy!”. This refers not only to home prices but also mortgage interest rates. When you run your amortization table, you’ll see what a difference a 1% rate change can make. Here is a chart of the history of mortgage interest rates from Zillow. You be the judge.