Introduction: Lost in the implosion of the securitized markets sits an overlooked yet just as opaque remnant of the housing crisis – CDD or “Dirt Bonds”. Save for the rare fixed income aficionado, this segment is still to this day unknown. In general, a CDD is a local, special purpose government authorized by the state as an alternative method for managing and financing infrastructure required to support community development. In most cases, the community development is water, sewer, and drainage infrastructure to raw undeveloped lots. The CDD then levies assessments on the property. These taxes and assessments pay the construction, operation and maintenance costs of the district and are set annually by the governing board of the district. The taxes and assessments are in addition to county and other local governmental taxes and assessments and all other taxes and assessment provided for by law.

Like the developments in the well-known mortgage backed securities markets, the progression of the CDD market combined two common elements: 1. An insatiable institutional demand for yield and 2. the housing boom. According to the Florida CDD report, there are over 600 CDD districts in Florida that have issued more than $6.5 billion in municipal bonds to finance their infrastructure. It’s estimated that over $3billion in bonds are now in default. The lion’s share of these bonds is held in high yield municipal bond funds.

During the height of the housing boom, CDD funding provided extra fuel to develop the next master planned neighborhood/development. Real estate developers would hold the unsold lots until they could be built and sold. All is fine as long as the music keeps playing. Unfortunately, hundreds of developments now sit partially built with nothing but dirt as the bondholder’s collateral.

As you might suspect, valuation of illiquid assets such as this has been a big issue throughout the credit crisis. The WSJ forewarned of this particular issue in a late February column here. As an investor and seeker of value across the capital structure, I decided to randomly pick a bond and attempt to value it myself. Here we go.

Collateral: River Bend Community Development District “CDD” was created in 2005. The total River Bend Community consists of a total of 752 homesites. Specifically, 369 lots are encumbered by the 2005 Series A bond issue. The remaining 383 lots (consisting of 50’, 60’, 70’, 80’, 90’, and 100’ foot lots) back the 2007 B bond. At this time 73 lots are owner occupied private residences. 54 lots are owned by Lennar and are current in their payments. The remaining 256 are owned by the original land developer, the Ryan Group, which has since gone bankrupt.

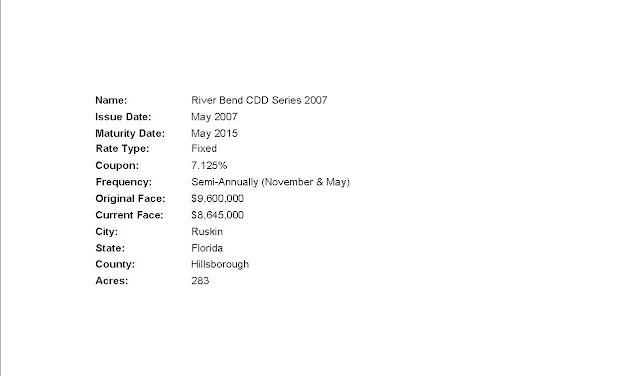

Bond Details: As this bond is a non-amortizing instrument, there are two ways for the principal to be repaid: 1) at the close from developer to builder or from builder to end user 2) on the maturity date of the bond; whichever comes first. At the current time $8.3 of the $9.6mil remains outstanding. Regardless of whether or not a homeowner/builder/developer has paid the principal payment for each respective lot, the assessment/interest payment continues to be made on the original amount of the bond.

CDD assessments are broken down between debt service & operations and maintenance (O&M). For the purposes of this analysis, references to the assessments will mean the debt-service portions. District Management Services “DMS” is the property manager for the River Bend CDD. Upon request, they provided me with the tax roll, and most up to data financial statements.

Repayment Sources:

- Assessments from existing homeowners - As the yearly assessments are senior to even the homeowners’ mortgage, we can be reasonably certain that the yearly dues will be paid. 73 units have to pay semi-annual assessments of $589. That being said, a handful of the developed units have gone into short sale and looming foreclosure. If these homeowners fail to maintain the properties how sure can we be that the annual assessments will be paid?

- Assessments from Lennar Owned Lots- Lennar currently owns 54 lots. Yearly assessments on these lots run $63,612 for just the debt service portion of the assessment. See table below.

- Principal Payments for Lennar Owned Lots- Lennar owes $16,543 per lot the sooner of sale of the lot or the maturity of the bond. This comes out to ~$893k. I assume that the balance is paid, and it is paid at the latest point possible, the maturity of the bond in May 2015. I find it HIGHLY unlikely that investors ever see this money. The more likely scenario is that Lennar lets the lots go as there have been zero non short-sale transactions over the past year or so. It is a negative economic decision for Lennar to continue paying property taxes and assessments on a development that has zero interest or buyer traffic.

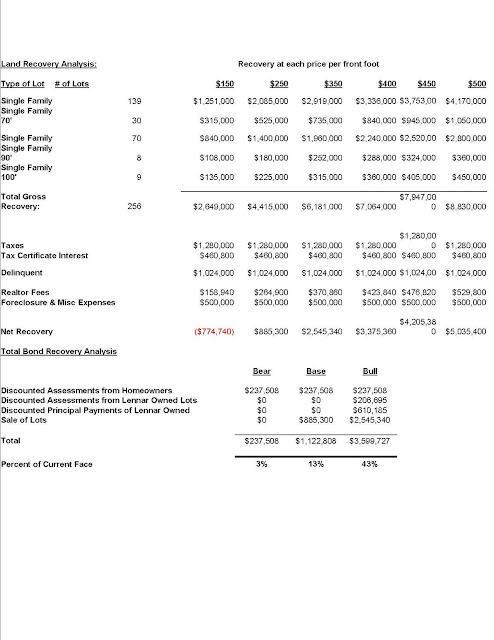

- Sale of Developer Lots- The defaulted developer (The Ryan Group) owns the remaining 256 lots, of which prior year assessments and full principal balances are still owed. $7.5mil of the original $9.6mil balance is owed by the vacant developer lots or ~78% of the original balance. ~$4k of delinqent CDD assessment fees are owed by each lot. Based on discussions with local land brokers there is “zero” interest in this area of Tampa. Another broker immediately noted that these particular lots are encumbered by CDD debt. Why would anybody buy lots (in an area best described as a housing bust ghost town) when they would immediately owe the back taxes and CDD principal debt.

Liabilities

Delinquent Taxes- Approximately $5k per lot of delinquent taxes (2007-Current) is owed by each lot.

Realtor Fees- The below analysis assumes a 6% realtor fee on the gross sale value.

Tax Certificate Payments- Various tax certificates have been purchased. I assume two years of interest (18%) on the outstanding balances is accrued and paid out of the gross sale proceeds.

Foreclosure & Misc Expenses- To be conservative, I included (arbitrarily) an extra $500k for miscellaneous and/or legal expenses.

Land Recovery Overview: My approach of analyzing the recovery potential of the land took two different forms:

A. Consultation with Industry Experts-

- Broker “A” – “A” originally sold the River Bend lots to Lennar and was on the board of directors for the CDD up until 2007-2008. He said that “nothing is being sold south of Tampa” and that “the CDD overhang will make it tough”. He commented that Ruskin is a bit of a drive from Tampa (~40mins), so it is an unpopular spot for would-be workers of Tampa.

- Broker “B” – A prominent figure in the greater Tampa real estate scene, “B” had little/no interest in speaking with me about the River Bend lots. Assuming I had no prior knowledge he immediately said “You know these have CDD debt behind them?”.

B. Site Visit

Visiting the site in Florida was instrumental in providing a qualitative “smell check”. All in all, you needed to drive through very run down areas of outer Tampa to arrive in the community. There is no on-site worker from Lennar, presumably because there is little/no interest in anyone living there. Mobile Zillow & Realtor quickly identified that numerous of the houses for sale were in fact short sales.

Conclusion:

After spending a fair amount of time researching this bond and the probability of future cash flows, I was surprised at the distressed nature of the security. I could be off-base, but it seems highly unlikely that Lennar would continue to make principal, interest, and tax payments on lots with no apparent demand and overhang & headwinds from existing homes in foreclosure.

Furthermore, given the supply glut of existing lots and inventory, the local land experts relayed extreme bearishness at the prospect of selling the lots. A very large mutual fund family is holding the bond at ~43 cents on the dollar. Is this valuation possible? Yes, but based on what I have uncovered it could be argued that the likelihood of principal repayment could be substantially less than that.

While this bond may or may not be representative of the whole mutual fund universe, it raises questions about how accurately funds are valuing the bonds. The conclusion of this analysis leaves far more questions than answers.

Disclosure: The views stated here are entirely my own and do not reflect those of any organization or firm. I currently have no interest in any CDD bond.

economicmusings posted this