24

Jun

The Four Stages of Disruption

In honor of yesterdays big headline (big VC Andressen Horowitz bought big into big data via a big investment (a cool $90 million) in Tanium - the first and only security and systems management solution to allow truly real-time data collection and change at enterprise scale.) The Four Stages of Disruption via 160z by Stevesi

Innovation and disruption are the hallmarks of the technology world, and hardly a moment passes when we are not thinking, doing, or talking about these topics. While I was speaking with some entrepreneurs recently on the topic, the question kept coming up: “If we’re so aware of disruption, then why do successful products (or companies) keep getting disrupted?”

Good question, and here’s how I think about answering it.

As far back as 1962, Everett Rogers began his groundbreaking work defining the process and diffusion of innovation. Rogers defined the spread of innovation in the stages of knowledge, persuasion, decision, implementation and confirmation.

Those powerful concepts, however, do not fully describe disruptive technologies and products, and the impact on the existing technology base or companies that built it. Disruption is a critical element of the evolution of technology — from the positive and negative aspects of disruption a typical pattern emerges, as new technologies come to market and subsequently take hold.

A central question to disruption is whether it is inevitable or preventable. History would tend toward inevitable, but an engineer’s optimism might describe the disruption that a new technology can bring more as a problem to be solved.

The Four Stages of Disruption

For incumbents, the stages of innovation for a technology product that ultimately disrupt follow a pattern that is fairly well known. While that doesn’t grant us the predictive powers to know whether an innovation will ultimately disrupt, we can use a model to understand what design choices to prioritize, and when. In other words, the pattern is likely necessary, but not sufficient to fend off disruption. Value exists in identifying the response and emotions surrounding each phase of the innovation pattern, because, as with disruption itself, the actions/reactions of incumbents and innovators play important roles in how parties progress through innovation. In some ways, the response and emotions to undergoing disruption are analogous to the classic stages of grieving.

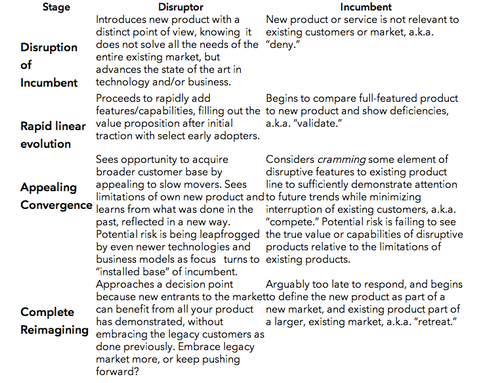

Rather than the five stages of grief, we can describe four stages that comprise theinnovation pattern for technology products: Disruption of incumbent; rapid and linear evolution; appealing convergence; and complete reimagination. Any product line or technology can be placed in this sequence at a given time.

The pattern of disruption can be thought of as follows, keeping in mind that at any given time for any given category, different products and companies are likely at different stages relative to some local “end point” of innovation.

The Four Stages of Disruption

For incumbents, the stages of innovation for a technology product that ultimately disrupt follow a pattern that is fairly well known. While that doesn’t grant us the predictive powers to know whether an innovation will ultimately disrupt, we can use a model to understand what design choices to prioritize, and when. In other words, the pattern is likely necessary, but not sufficient to fend off disruption. Value exists in identifying the response and emotions surrounding each phase of the innovation pattern, because, as with disruption itself, the actions/reactions of incumbents and innovators play important roles in how parties progress through innovation. In some ways, the response and emotions to undergoing disruption are analogous to the classic stages of grieving.

Rather than the five stages of grief, we can describe four stages that comprise theinnovation pattern for technology products: Disruption of incumbent; rapid and linear evolution; appealing convergence; and complete reimagination. Any product line or technology can be placed in this sequence at a given time.

The pattern of disruption can be thought of as follows, keeping in mind that at any given time for any given category, different products and companies are likely at different stages relative to some local “end point” of innovation.

Stage One: Disruption of Incumbent

A moment of disruption is where the conversation about disruption often begins, even though determining that moment is entirely hindsight. (For example, when did BlackBerry get disrupted by the iPhone, film by digital imaging or bookstores by Amazon?) A new technology, product or service is available, and it seems to some to be a limited, but different, replacement for some existing, widely used and satisfactory solution. Most everyone is familiar with this stage of innovation. In fact, it could be argued that most are so familiar with this aspect that collectively our industry cries “disruption” far more often than is actually the case.

From a product development perspective, choosing whether a technology is disruptive at a potential moment is key. If you are making a new product, then you’re “betting the business” on a new technology — and doing so will be counterintuitive to many around you. If you have already built a business around a successful existing product, then your “bet the business” choice is whether or not to redirect efforts to a new technology. While difficult to prove, most would generally assert that new technologies that are subsequently disruptive are bet on by new companies first. The very nature of disruption is such that existing enterprises see more downside risk in betting the company than they see upside return in a new technology. This is the innovator’s dilemma.

The incumbent’s reactions to potential technology disruptions are practically cliche. New technologies are inferior. New products do not do all the things existing products do, or are inefficient. New services fail to address existing needs as well as what is already in place. Disruption can seem more expensive because the technologies have not yet scaled, or can seem cheaper because they simply do less. Of course, the new products are usually viewed as minimalist or as toys, and often unrelated to the core business. Additionally, business-model disruption has similar analogues relative to margins, channels, partners, revenue approaches and more.

The primary incumbent reaction during this phase is to essentially ignore the product or technology — not every individual in an organization, but the organization as a whole often enters this state of denial. One of the historical realities of disruption is uncovering the “told you so” evidence, which is always there, because no matter what happens, someone always said it would. The larger the organization, the more individuals probably sent mail or had potential early-stage work that could have avoided disruption, at least in their views (see “Disruption and Woulda, Coulda, Shoulda” and the case of BlackBerry). One of the key roles of a company is to make choices, and choosing change to a more risky course versus defense of the current approaches are the very choices that hamstring an organization.

There are dozens of examples of disruptive technologies and products. And the reactions (or inactions) of incumbents are legendary. One example that illustrates this point would be the introduction of the “PC as a server.” This has all of the hallmarks of disruption. The first customers to begin to use PCs as servers — for application workloads such as file sharing, or early client/server development — ran into incredible challenges relative to the mini/mainframe computing model. While new PCs were far more flexible and less expensive, they lacked the reliability, horsepower and tooling to supplant existing models. Those in the mini/mainframe world could remain comfortable observing the lack of those traits, almost dismissing PC servers as not “real servers,” while they continued on their path further distancing themselves from the capabilities of PC servers, refining their products and businesses for a growing base of customers. PCs as servers were simply toys.

At the same time, PC servers began to evolve and demonstrate richer models for application development (rich client front-ends), lower cost and scalable databases, and better economics for new application development. With the rapidly increasing demand for computing solutions to business problems, this wave of PC servers fit the bill. Soon the number of new applications written in this new way began to dwarf development on “real servers,” and the once-important servers became legacy relative to PC-based servers for those making the bet or shift. PC servers would soon begin to transition from disruption to broad adoption, but first the value proposition needed to be completed.

Stage Two: Rapid Linear Evolution

Once an innovative product or technology begins rapid adoption, the focus becomes “filling out” the product. In this phase, the product creators are still disruptors, innovating along the trajectory they set for themselves, with a strong focus on early-adopter customers, themselves disruptors. The disruptors are following their vision. The incumbents continue along their existing and successful trajectory, unknowingly sealing their fate.

This phase is critically important to understand from a product-development perspective. As a disruptive force, new products bring to the table a new way of looking at things — a counterculture, a revolution, an insurgency. The heroic efforts to bring a product or service to market (and the associated business models) leave a lot of room left to improve, often referred to as “low-hanging fruit.” The path from where one is today to the next six, 12, 18 months is well understood. You draw from the cutting-room floor of ideas that got you to where you are. Moving forward might even mean fixing or redoing some of the earlier decisions made with less information, or out of urgency.

Generally, your business approach follows the initial plan, as well, and has analogous elements of insurgency. Innovation proceeds rapidly in this point. Your focus is on the adopters of your product — your fellow disruptors (disrupting within their context). You are adding features critical to completing the scenario you set out to develop.

To the incumbent leaders, you look like you are digging in your heels for a losing battle. In their view, your vector points in the wrong direction, and you’re throwing good money after bad. This only further reinforces the view of disruptors that they are heading in the right direction. The previous generals are fighting the last war, and the disruptors have opened up a new front. And yet, the traction in the disruptor camp becomes undeniable. The incumbent begins to mount a response. That response is somewhere between dismissive and negative, and focuses on comparing the products by using the existing criteria established by the incumbent. The net effect of this effort is to validate the insurgency.

Stage Three: Appealing Convergence

As the market redefinition proceeds, the category of a new product starts to undergo a subtle redefinition. No longer is it enough to do new things well; the market begins to call for the replacement of the incumbent technology with the new technology. In this phase, the entire market begins to “wake up” to the capabilities of the new product.

As the disruptive product rapidly evolves, the initial vision becomes relatively complete (realizing that nothing is ever finished, but the scenarios overall start to fill in). The treadmill of rapidly evolving features begins to feel somewhat incremental, and relatively known to the team. The business starts to feel saturated. Overall, the early adopters are now a maturing group, and a sense of stability develops.

Looking broadly at the landscape, it is clear that the next battleground is to go after the incumbent customers who have not made the move. In other words, once you’ve conquered the greenfield you created, you check your rearview mirror and look to pick up the broad base of customers who did not see your product as market-ready or scenario-complete. To accomplish this, you look differently at your own product and see what is missing relative to the competition you just left in the dust. You begin to realize that all those things your competitor had that you don’t may not be such bad ideas after all. Maybe those folks you disrupted knew something, and had some insights that your market category could benefit from putting to work.

In looking at many disruptive technologies and disruptors, the pattern of looking back to move forward is typical. One can almost think of this as a natural maturing; you promise never to do some of the things your parents did, until one day you find yourself thinking, “Oh my, I’ve become my parents.” The reason that products are destined to converge along these lines is simply practical engineering. Even when technologies are disrupted, the older technologies evolved for a reason, and those reasons are often still valid. The disruptors have the advantage of looking at those problems and solving them in their newly defined context, which can often lead to improved solutions (easier to deploy, cheaper, etc.) At the same time, there is also a risk of second-system syndrome that must be carefully monitored. It is not uncommon for the renegade disruptors, fresh off the success they have been seeing, to come to believe in broader theories of unification or architecture and simply try to get too much done, or to lose the elegance of the newly defined solution.

Stage Four: Complete Reimagination

The last stage of technology disruption is when a category or technology is reimagined from the ground up. While one can consider this just another disruption, it is a unique stage in this taxonomy because of the responses from both the legacy incumbent and the disruptor.

Reimagining a technology or product is a return to first principles. It is about looking at the underlying assumptions and essentially rethinking all of them at once. What does it mean to capture an image,provide transportation, share computation, search the Web, and more? The reimagined technology often has little resemblance to the legacy, and often has the appearance of even making the previous disruptive technology appear to be legacy. The melding of old and new into a completely different solution often creates whole new categories of products and services, built upon a base of technology that appears completely different.

To those who have been through the first disruption, their knowledge or reference frame seems dated. There is also a feeling of being unable to keep up. The words are known, but the specifics seem like rocket science. Where there was comfort in the convergence of ideas, the newly reimagined world seems like a whole new generation, and so much more than a competitor.

In software, one way to think of this is generational. The disruptors studied the incumbents in university, and then went on to use that knowledge to build a better mousetrap. Those in university while the new mousetrap was being built benefited from learning from both a legacy and new perspective, thus seeing again how to disrupt. It is often this fortuitous timing that defines generations in technologies.

Reimagining is important because the breakthroughs so clearly subsume all that came before. What characterizes a reimagination most is that it renders the criteria used to evaluate the previous products irrelevant. Often there are orders of magnitude difference in cost, performance, reliability, service and features. Things are just wildly better. That’s why some have referred to this as the innovator’s curse. There’s no time to bask in the glory of the previous success, as there’s a disruptor following right up on your heels.

A recent example is cloud computing. Cloud computing is a reimagination ofboth the mini/mainframe and PC-server models. By some accounts, it is a hybrid of those two, taking the commodity hardware of the PC world and the thin client/data center view of the mainframe world. One would really have to squint in order to claim it is just that, however, as the fundamental innovation in cloud computing delivers entirely new scale, reliability and flexibility, at a cost that upends both of those models. Literally every assumption of the mainframe and client/server computing was revisited, intentionally or not, in building modern cloud systems.

For the previous incumbent, it is too late. There’s no way to sprinkle some reimagination on your product. The logical path, and the one most frequently taken, is to “mine the installed base,” and work hard to keep those customers happy and minimize the mass defections from your product. The question then becomes one of building an entirely new product that meets these new criteria, but from within the existing enterprise. The number of times this has been successfully accomplished is diminishingly small, but there will always be exceptions to the rule.

For the previous disruptor and new leader, there is a decision point that is almost unexpected. One might consider the drastic — simply learn from what you previously did, and essentially abandon your work and start over using what you learned. Or you could be more incremental, and get straight to the convergence phase with the latest technologies. It feels like the ground is moving beneath you. Can you converge rapidly, perhaps revisiting more assumptions, and show more flexibility to abandon some things while doing new things? Will your product architecture and technologies sustain this type of rethinking? Your customer base is relatively new, and was just feeling pretty good about winning, so the pressure to keep winning will be high. Will you do more than try to recast your work in this new light?

The relentless march of technology change comes faster than you think.

So What Can You Do?

Some sincerely believe that products, and thus companies, disrupt and then are doomed to be disrupted. Like a Starship captain when the shields are down, you simply tell all hands to brace themselves, and then see what’s left after the attack. Business and product development, however, are social sciences. There are no laws of nature, and nothing is certain to happen. There are patterns, which can be helpful signposts, or can blind you to potential actions. This is what makes the technology industry, and the changes technology bring to other industries, so exciting and interesting.

The following table summarizes the stages of disruption and the typical actions and reactions at each stage:

Considering these stages and reactions, there are really two key decision points to be tuned-in to:

When you’re the incumbent, your key decision is to choose carefully what you view as disruptive or not. It is to the benefit of every competitor to claim they are disrupting your products and business. Creating this sort of chaos is something that causes untold consternation in a large organization. Unfortunately, there are no magic answers for the incumbent.

The business team needs to develop a keen understanding of the dynamics of competitive offerings, and know when a new model can offer more to customers and partners in a different way. More importantly, it must avoid an excess attachment to today’s measures of success.

The technology and product team needs to maintain a clinical detachment from the existing body of work to evaluate if something new is better, while also avoiding the more common technology trap of being attracted to the next shiny object.

When you’re the disruptor, your key decision point is really when and if to embrace convergence. Once you make the choices — in terms of business model or product offering — to embrace the point of view of the incumbent, you stand to gain from the bridge to the existing base of customers.

Alternatively, you create the potential to lose big to the next disruptor who takes the best of what you offer and leapfrogs the convergence stage with a truly reimagined product. By bridging to the legacy, you also run the risk of focusing your business and product plans on the customers least likely to keep pushing you forward, or those least likely to be aggressive and growing organizations. You run the risk of looking backward more than forward.

For everyone, timing is everything. We often look at disruption in hindsight, and choose disruptive moments based on product availability (or lack thereof). In practice, products require time to conceive, iterate and execute, and different companies will work on these at different paces. Apple famously talked about the 10-year project that was the iPhone, with many gaps, and while the iPad appears a quick successor, it, too, was part of that odyssey. Sometimes a new product appears to be a response to a new entry, but in reality it was under development for perhaps the same amount of time as another entry.

There are many examples of this path to disruption in technology businesses. While many seem “classic” today, the players at the time more often than not exhibited the actions and reactions described here.

As a social science, business does not lend itself to provable operational rules. As appealing as disruption theory might be, the context and actions of many parties create unique circumstances each and every time. There is no guarantee that new technologies and products will disrupt incumbents, just as there is no certainty that existing companies must be disrupted. Instead, product leaders look to patterns, and model their choices in an effort to create a new path.

Phases of Disruption In Practice

Digital imaging. Mobile imaging reimagined a category that disrupted film (always available, low-quality versus film), while converging on the historic form factors and usage of film cameras. In parallel, there is a wave of reimagination of digital imaging taking place that fundamentally changes imaging using light field technology, setting the stage for a potential leapfrog scenario.

Retail purchasing. Web retailers disrupted physical retailers with selection, convenience, community, etc., ultimatelyconverging on many elements of traditional retailers (physical retail presence, logistics, house brands).

Travel booking. Online travel booking is disrupting travel agents, then converging on historic models of aggregation and package deals.

Portable music. From the Sony Walkman as a disruptor to the iPod and MP3 players, to mobile phones subsuming this functionality, and now to streaming playback, portable music has seen the disruptors get disrupted and incumbents seemingly stopped in their tracks over several generations. The change in scenarios enabled by changing technology infrastructure (increased storage, increased bandwidth, mobile bandwidth and more) have made this a very dynamic space.

Urban transport. Ride sharing, car sharing, and more disruptive traditional ownership of vehicles or taxi services are in the process of converging models (such as Uber adding UberX.

Productivity tools such as Quip, Box, Haiku Deck, Lucidchart, and more are being pulled by customers beyond early adopters to be compatible with existing tools and usage patterns. In practice, these tools are currently iterating very rapidly along their self-defined disruptive path. Some might suggest that previous disruptors in the space (OpenOffice, Zoho, perhaps even Google Docs) chose to converge with the existing market too soon, as a strategic misstep.

Movie viewing. Netflix and others, as part of cord-cutting, with disruptive, low-priced, all-you-can-consume on-demand plans and producing their own content. Previous disruptors such as HBO are working to provide streaming and similar services, while constrained by existing business models and relationships.

Messaging/communications apps. SMS, which many consider disruptive to 2000-era IM, is being challenged by much richer interactions that disrupt the business models of carrier SMS and feature sets afforded by SMS.

Network infrastructure. Software-defined networking and cloud computing are reimagining the category of networking infrastructure, with incumbent players attempting to benefit from these shifts in the needs of customers. Incumbents at different levels are looking to adopt the model, while some providers see it as fundamentally questioning their assumptions.

Steven Sinofsky is a board partner at Andreessen Horowitz, an adviser at Box Inc. and an executive in residence at Harvard Business School. Follow him @stevesi. This story originally appeared on Recode.

brandondonnelly liked this

jetsetfarryn posted this